No products in the cart.

Health Reimbursement Accounts (HRAs), Health Savings Accounts (HSAs), and Flexible Spending Accounts (FSAs) can be great cost-savings tools. FSA and HSA accounts are funded by individuals while employers fund HRA accounts. These accounts allow money to be set aside on a pre-tax basis to pay for qualified medical expenses such as deductibles, prescriptions, and equipment/supplies. People do not have to pay taxes on the money that they put into their FSA and HSA accounts. They can also choose from a wider range of options when selecting personal medical equipment.

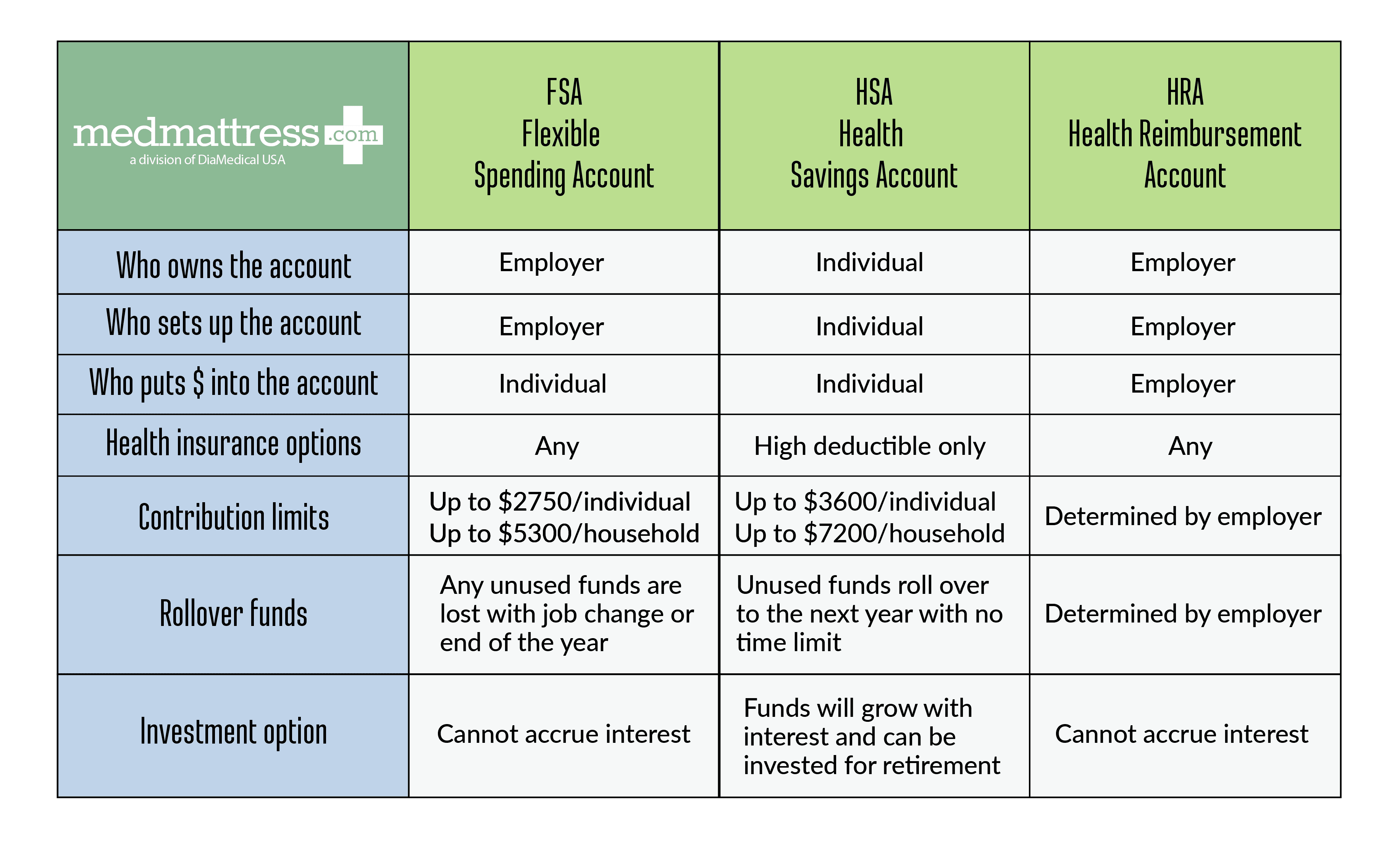

Flexible Spending Accounts (FSAs)

FSA accounts are set up and owned by employers; they come only as part of a benefits package and employees cannot start FSA accounts on their own. Some employers may decide to contribute to their employees’ FSA accounts but it is not required. The IRS limits the amount of money that employers can put into their FSA accounts. One person can have up to $2,750 per year and a family can have up to $5,300 per year. Money for an FSA account is deducted from each paycheck before taxes. No tax must be paid when the funds are used to pay for qualified medical expenses. This helps people save money on healthcare costs, especially because FSA accounts can be used with any type of health insurance. People cannot keep their FSA accounts when they change jobs and start working for a new employer.

Health Savings Accounts (HSAs)

HSA accounts are set up by people with high deductible health plans (HDHP). HDHP health insurance is relatively inexpensive due to high deductibles and copays. HSA accounts allow people to set aside money to pay for medical costs if they arise. People must meet certain criteria to qualify for an HSA account. An HDHP must be the person’s only health insurance plan and the person must not be eligible for Medicare. The person also cannot be claimed as a dependent on someone else’s tax return.

People may use pre-tax payroll deductions or direct payments to fund HSA accounts. Like FSAs, no tax is paid when funds are used to pay qualified medical expenses. The IRS limits the amount of money that people can put into their HSA accounts. One person can have up to $3,600 per year and a family can have up to $7,200 per year. Any unused money in an HSA account will roll over to the next year. There is no time limit for accessing HSA funds. The money in an HSA account will accrue interest over time so some people save the funds to use during retirement. Because HSA accounts are owned by the individual, they are kept for life regardless of job changes.

Health Reimbursement Accounts (HRAs)

HRA accounts are set up, owned, and funded by employers. HRA accounts are different from HSA and FSA accounts because they are paid for by employers rather than individuals. The employer decides how much money will be added each year. The employer also decides which medical expenses may be paid for by the HRA. Some HRA accounts are designed to pay for dental and vision care that are not included in the company’s insurance plan. People lose their HRA accounts when they change employers but sometimes funds are made available for retirement. HRA accounts may be used with any type of health insurance, including HDHP plans and Medicare.

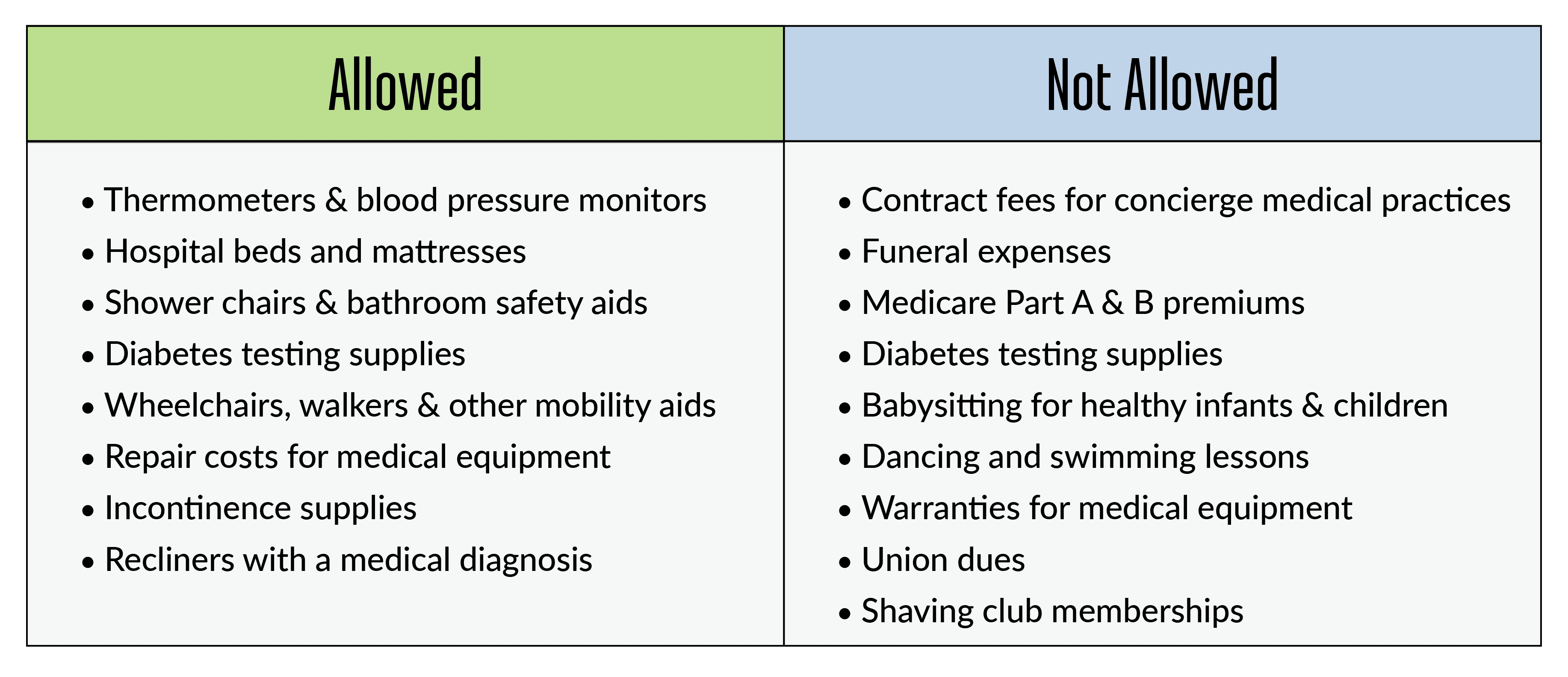

FSA, HSA, and HRA Qualified Medical Expenses

People can use FSA, HSA, and HRA accounts to pay for many types of medical expenses. The IRS determines which expenses are allowed for FSA and HSA accounts and the employer decides for HRA accounts. Examples include:

FSA, HSA & HRA Comparison Chart

You might also be interested in:

-

/

Rest for Success: When to Bid Adieu to Your Old Mattress

Rest for Success: When to Bid Adieu to Your Old Mattress We spend about a third of our lives in bed, and the quality of our sleep directly impacts our overall well-being. One often overlooked factor in achieving a good night’s sleep is the condition of our mattress. As the years go by, our faithful […]

Read more

Unveiling the Truth: Busting Common Mattress Myths

Unveiling the Truth: Busting Common Mattress Myths A good night’s sleep is crucial for overall well-being, and the right mattress plays a pivotal role in achieving that. However, amidst the quest for the perfect mattress, numerous misconceptions have caused mattress shoppers confusion when searching for the right mattress. Our latest blog unravels the truth behind […]

Read more

-

/

How Medical Bed Mattresses Aid in Post-Surgery Recovery

How Medical Bed Mattresses Aid in Post-Surgery Recovery Surgery can be a daunting experience, regardless of its nature or severity. The period following a surgical procedure, known as post-surgery recovery, is crucial for achieving the best possible outcome. While factors like rest, nutrition and pain management are widely acknowledged as vital, the role that medical […]

Read more

-

/

Meeting Medical Mattress Quality Standards

Meeting Medical Mattress Quality Standards Medical mattresses are designed to meet specific quality standards to ensure patient safety, comfort and hygiene. These standards are established to address the unique needs of healthcare environments as well as the patients utilizing these mattresses. Some key quality standards for medical mattresses include: Infection Control Standards Water […]

Read more